Double Entry for Provision for Doubtful Debts

Inventory valuation and its impact on financial statements is also covered. Other items Sales return reserve for discount on accounts payable.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

What is the entry for provision for bad debts.

. Your allowance for doubtful accounts estimation for the two aging periods would be 550 300 250Allowance for doubtful accounts journal entryWhen it comes to bad debt and ADA there are a few scenarios you. Calculate total Assets to debt ratio from the following. Outline the double entry system of book-keeping.

Polaris ranger idle adjustment. Long term debts Rs3200000 Rs250000 Rs20000 Rs100000 Rs. General reserve provision for doubtful debts.

On the other hand excise duty is subsumed in GST and so there are no chances of double taxation on such items. Enter the email address you signed up with and well email you a reset link. 30000 Long term debts Rs.

Under VAT system input tax credit cannot be availed in case of interstate sales. Farol ltd thame. Guarantee product warranties Requirements for creating provision.

It is calculated to cover the cost of debts that are expected to remain unpaid during an accounting period. 8333 can be charged to the revaluation surplus account. Provision for discount on accounts receivable etc.

Ram started business with cash Rs. Iv A provision for bad and doubtful debts is to be created at 5 of debtors. Below is the Calculation of Long term Debts-Long term debts total Debts- Creditors Bills payables- Short term Borrowings Outstanding Exp.

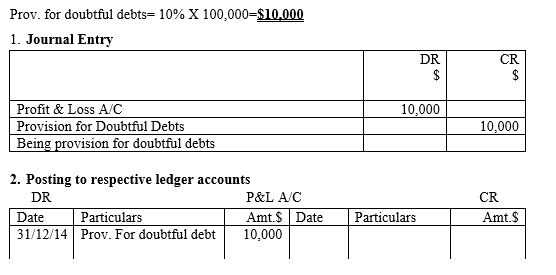

The provision for doubtful debts which is also referred to as the provision for bad debts or the provision for losses on accounts receivable is an estimation of the amount of doubtful debt that will need to be written off during a given period. Provision is provided for doubtful debts is based on the principle of. Also notice that in the first entry the estimated uncollectible accounts and allowance for doubtful accounts are.

27 Double entry system is used in which type of accounting A Financial B Cost C Management D All. C Double entry system Books of prime entry Subsidiary Books Cash Book d Journal Ledger Trial Balance e Depreciation Methods Straight Line and Diminishing Balance methods only f Rectification of Errors g Opening entries Transfer entries Adjustment entries Closing entries h Bank Reconciliation Statements 2. In balance sheet the balance in allowance for doubtful accounts is deducted from the total receivables to report them at their net realizable value or carrying value.

Due to this principle the two sides of Balance Sheet are always equal and the following accounting equation will always hold good at any point of time. We also learned that all individual debtor T-accounts go in the debtors ledger and all individual creditor T-accounts go in the creditors ledger. For example here is a debtors ledger with a number of individual.

Bad debt expense Wrong. 21 The System of Double Entry of Book-Keeping. The system of recording transaction based on this principle is called as Double.

Carrying value of asset at the end of year 3 would be as follows. According to a double-entry system every transaction is recorded in a journal debiting one account and crediting the other for the same amount of money with an explanation. The path does not contain any cycle which means path have finite number of vertices.

A provision can be created due to a number of factors. He has worked as an accountant and consultant for more than 25. Enter the email address you signed up with and well email you a reset link.

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. Treatments to record adjustments for accruals and prepayments bad debts provision of doubtful debts and bad debts recovered are included. The mootness of the case in relation to the WMCP FTAA led the undersigned ponente to state in his dissent to the Decision that there was no more justiciable controversy and the plea to nullify the Mining Law has become a virtual petition for declaratory relief26 The entry of the Chamber of Mines of the Philippines Inc however has put into.

Example From the following transactions identify the accounts involved and classify them according to modern and traditional approaches of classification of accounts. Allowance for doubtful accounts Wrong. Now lets assume that at the start of year 4 company identifies that value of asset has decreased to.

7A provision for potential bad debts in accounts receivable is debited to which account. The other examples of provisions are. A contract is a legally enforceable agreement that creates defines and governs mutual rights and obligations among its parties.

Jul 27 2021 Given two nodes start and end find the path with the maximum probability. A contract typically involves the transfer of goods services money or a promise to transfer any of those at a future dateIn the event of a breach of contract the injured party may seek judicial remedies such as damages or rescission. V Creditors were unrecorded to the extent of 1000.

- The Debtors Ledger - The Creditors Ledger. As previously mentioned we not only have the general ledger but also two other subsidiary or supporting ledgers. New dune buggy street legal.

Alternatively while recoding the entry for depreciation incremental depreciation due to the revaluation ie. The solution for this question is as follows. Dividends received in Brunei Darussalam from the United Kingdom or Commonwealth countries are grossed up in the tax computation and credit is claimed against the Brunei tax liability for tax suffered either under the double tax treaty with the United Kingdom or provision for Commonwealth tax relief.

Allowance for doubtful accounts Right. Assets Liabilities Capital. Pass the necessary journal entries prepare the revaluation account and partners capital accounts and show the Balance Sheet after the admission of C.

Given the directed connected and unweighted graph G and the task to find the number of all paths possible between two given vertices. In VAT system the manufacturer of excisable products is charged excise duty on its production and VAT on intra-state sales which causes double taxation.

Bad Debt Provision Accounting Double Entry Bookkeeping

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Accounting Nest Intermediate Bad Debts And Provision For Doubtful Debts

Understand How To Enter The Provision For Bad Debts Transactions Using The Double Entry System Youtube

0 Response to "Double Entry for Provision for Doubtful Debts"

Post a Comment